how much taxes will i owe for doordash

Her campaign hasnt yet released third-quarter. Determine the mortgage insurance rate.

How To Make 500 A Week With Doordash 2022 Guide

The deadline for income from the last three months of 2022 is January 17 2023.

. If your payment is less than one year late the penalty is 40 of the license fee you owe in addition to the regular taxes and fees. Microsoft is quietly building an Xbox mobile platform and store. DoorDash dashers will need a few tax forms to complete their taxes.

The 687 billion Activision Blizzard acquisition is key to Microsofts mobile gaming plans. The easiest way to determine the rate is to use a table on a lenders website. Which consist of your Social Security and Medicare taxes.

The IRS required DoorDash to send form 1099-NEC instead of 1099-MISC beginning in the 2020 tax year. Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised. How much are the penalties for late registration.

This is not tax advice and should not be taken as such. This means that if they abandon the property you wont even be able to earn back your investment by selling the property. The number of American households that were unbanked last year dropped to its lowest level since 2009 a dip due in part to people opening accounts to receive financial assistance during the.

That 7000 that you feel so good about really isnt yours. If you work with an employer this amount is split 5050 you pay 62 percent and your employer pays the other 62 percent. Yes - Just like everyone else youll need to pay taxes.

Do I owe taxes working for Doordash. Below are lists of the top 10 contributors to committees that have raised at least 1000000 and are primarily formed to support or oppose a state ballot measure or a candidate for state office in the November 2022 general election. Currently Social Security taxes amount to 124 percent of your income.

10 Best High Yield Savings Accounts Of November 2022. When youre self-employed you must. 182075499532 - 1 082075499532.

From 2014 through 2016 the tax gap which measures taxes owed versus paid grew to nearly 500 billion. That money you earned will be taxed. Amid rising prices and economic uncertaintyas well as deep partisan divisions over social and political issuesCalifornians are processing a great deal of information to help them choose state constitutional officers and.

The idea here is to get a feel for how much your Doordash income impacts your overall tax return. How much money has Tulsi Gabbard raised. California voters have now received their mail ballots and the November 8 general election has entered its final stage.

After a year the penalty goes up to 80 of the fee on top of the regular payment. When youre an employee you owe 765 for these and your employer pays the other 765. There are too many moving pieces in your tax picture for me to do that.

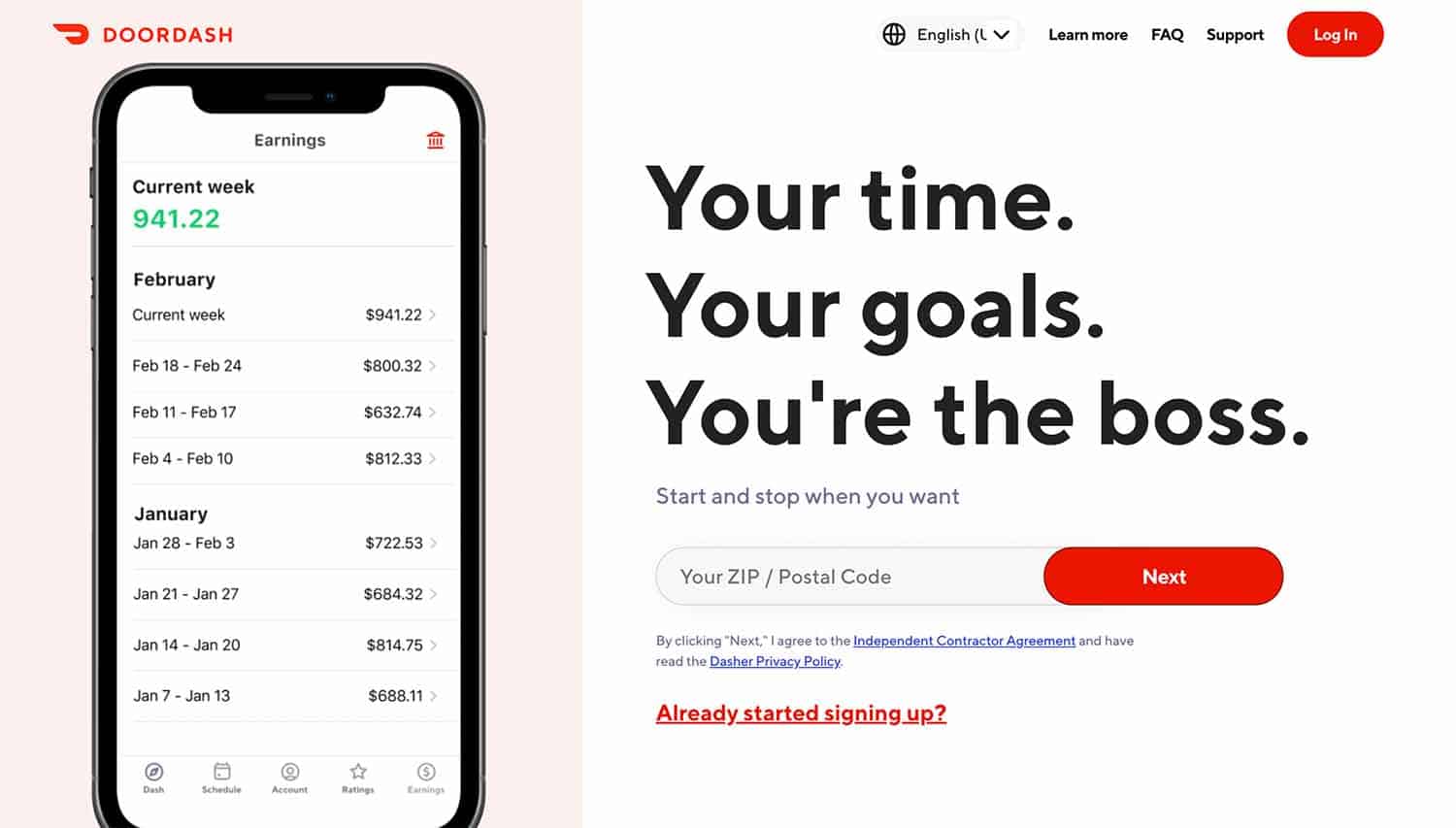

PMI fees vary depending on the size of the down payment and the loan from around 03 percent to 115 percent of the original loan amount per year. Taxes for the period from June 1 to August 31 are due on Sept. DoorDash dashers who earned more than 600 in the previous calendar year will receive a 1099-NEC form through their partner Strip.

The lists do not show all contributions to every state ballot measure or each independent expenditure committee formed to support or. But for the many people who dont use more than 3 or 4 GB of data a month this plan can offer. Avoid such places or at least invest with caution.

Plus youll keep 100 of any tips and bonuses. Lets say you have 7000 in your savings account but you owe 15000 in student loan debt. Sometimes occupants owe more in back taxes than the value of the home.

Once you accomplish this step the formula will appear much more manageable and will be that much closer to completion. See as long as you have debt to your name that money belongs to someone else. Its also worth considering how much better off the industry might be if Microsoft is forced to make serious concessions to get the deal passed.

The IRS released new data on how much in taxes is still unpaid by Americans and businesses. In addition to this most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks. Gabbard raised 16 million in the second quarter of 2019 and reported raising roughly 56 million overall.

Verizons 5 GB Shared Data plan can seem like a throwback among todays unlimited data plans. Stripe also sends 1099-Ks for other companies or payments but the way theyre set up with DoorDash means DoorDash work will go on a 1099-NEC for DoorDash. 182075499532 - 156743172467 0253323270652.

Government agency in charge of managing the Federal Tax Code Go to source You need to get a clear picture of what assets are included in your. Estate taxes are imposed on what is known as a persons gross estate before some reductions are allowed and you reach your taxable estate 4 X Trustworthy Source Internal Revenue Service US. Business Taxes Taxes Article Summary X If you want to contact the IRS about a personal tax matter try calling the toll-free IRS number at 1-800-829-1040 between the hours of 7am and 7pm Monday through Friday.

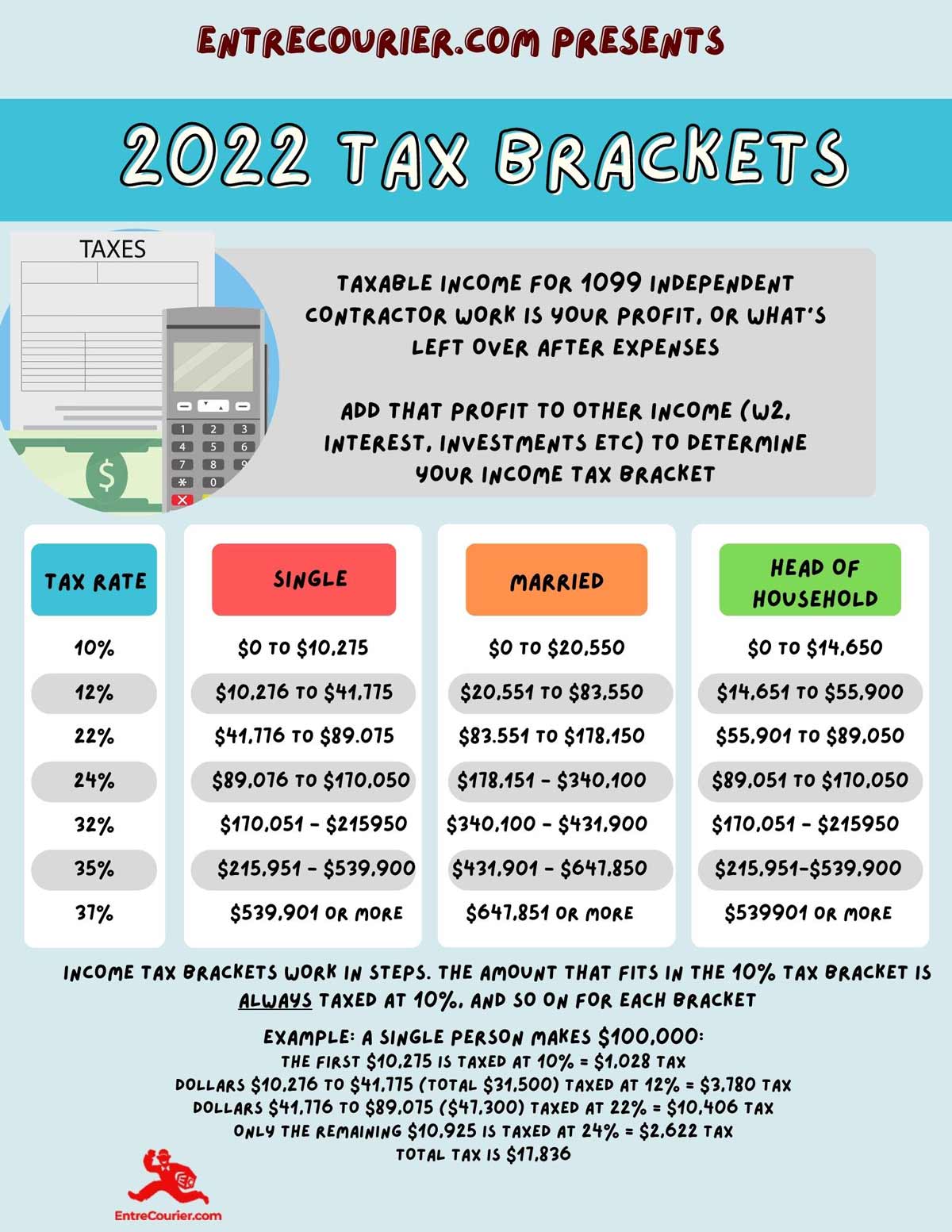

DoorDash uses Stripe to process their payments and tax returns. It doesnt apply only to DoorDash employees. Are calculated based on tax rates that range from 10 to 37.

Income taxes in the US. Here is a roundup of the forms required. If you earned more than 600 while working for DoorDash you are required to pay taxes.

Calculate the amount you owe in Social Security taxes. I wont try to tell you how much you will owe. To compensate for lost income you may have taken on some side jobs.

On the other hand Sonys fixation on Call of Duty is starting to look more and more like a greedy desperate death grip on a decaying business model a status quo Sony feels entitled to clinging to. As the Dasher youll know ahead of time how much DoorDash will pay you for completing the delivery. Remember if you choose to file an extension you are still required to pay any taxes you may owe by the April deadline.

The purpose is to educate and help you understand how taxes work. If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe. If you are expecting a tax refund that doesnt really matter - but you still need to file to claim your refund.

Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

Is Doordash Worth It 2022 Realistic Hourly Pay How To Sign Up

How Do I Begin Doordash Driving Everything You Need To Know Toughnickel

Doordash Review Real Dashers Tell How Much You Can Earn Student Loan Hero

Is Dashpass Worth It We Run The Numbers And Find Out

Tips For Filing Doordash Taxes Silver Tax Group

Doordash Tax Guide What Deductions Can Drivers Take Picnic Tax

Doordash 1099 Taxes And Write Offs Stride Blog

How Much Do Doordash Drivers Make Gridwise

How To Become A Doordash Driver Dasher Pay What To Expect Review

Is Doordash Worth It 2022 Realistic Hourly Pay How To Sign Up

Doordash Tax Calculator 2022 How Dasher Earnings Impact Taxes

How Much Does The Average Doordash Employee Make Per Hour Quora

Doordash Workers Protest Outside Ceo Tony Xu S Home Demanding Better Pay Tip Transparency And Ppe Techcrunch

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

Forgot To Track Your Miles We Ve Got You Covered 2020 Taxes